Fraud Detection System (FDS) with AI Technology

There are several industries that have grown noticeably in just a few years with the use of AI. From marketing and finance to medical fields that are evolving day by day due to the pandemic, any industry that collects and utilizes data is accelerating its growth. There is another area where AI can have a powerful impact – the cybersecurity field.

As the socially distanced society became the new norm, website forgery and infringement incidents also increased accordingly. Despite the decrease in the number of malware hidden site detection, the attack method advanced through APT attacks such as the distribution of malicious apps and malicious email. Although the target of an attack is not specifically determined, the e-commerce field, which has become more active in the rapid development of communications and change in the environment, became a major prey for hackers. Of course, the industrial sector that controls financial transactions is raising the level of security in preparation for these types of attacks.

In this blog, we will look at how the fraud detection system, FDS, and AI have evolved to defend against attacks from hackers targeting electronic financial transactions.

How Does it Work?

Fraud Detection System (FDS) is a system introduced to prevent financial fraud that has become difficult to detect as the volume of electronic financial transactions and the frequency of simple payments increased along with the diversification of payment methods.

In 2001, a hacker attacked Paypal, a representative e-commerce and internet payment service in the United States, and caused severe damage. This incident led to Paypal’s independent development of the security system, which can be seen as the initial reason for the development of FDS.

In the past, efforts were made to prevent hackers from invading by emphasizing user-side security through firewalls, focusing on strengthening real-time boundaries in the user part where actual transactions began. It collected, analyzed, and detected, and blocked abnormal transactions, and focused on security procedures in the server part after the transaction.

Therefore, FDS is playing a role in detecting and blocking abnormal transactions as a more active security measure compared to traditional security solutions in financial institutions such as banks, credit card companies, or Internet spaces equipped with online payment systems.

FDS and AI Technology

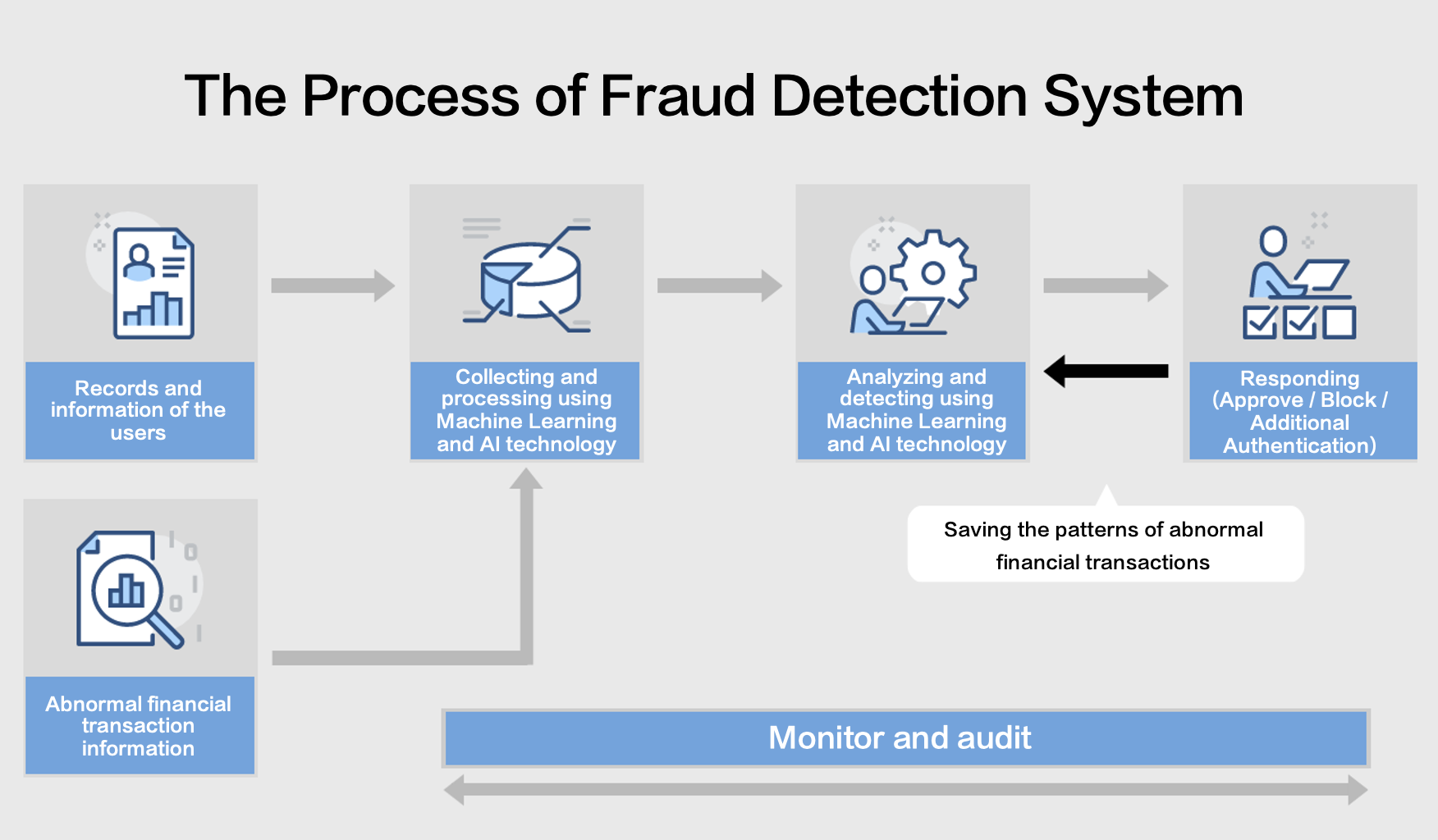

One of the biggest features of FDS is that AI technology is applied to realize higher effects in the information collection process, analysis and detection process. FDS is structured and operated in the following way:

1) Collecting and Processing the Information

By collecting and processing the information from the user’s financial transaction device, the data is utilized to the required form in the next step through quality improvement and quantitative reduction. In this process, machine learning is used for effective data processing.

2) Analyzing and Detecting

This step is to detect abnormal transactions by analyzing the previously processed financial transaction data and accumulated abnormal financial transaction patterns using machine learning. In this case, various AI analysis techniques such as detecting the misuse of data, abnormalities, and hybrid detection using deep learning are used.

3) Responding

In this step, additional authentication is performed for approval and blocking of transactions that are considered abnormal. Moreover, accumulating data and notifying the administrator and users can occur.

4) Monitoring and Auditing

Overall monitoring of the FDS process.

How Effective is the FDS?

Cases of preventing financial fraud with FDS can be found quite easily. Paypal, which deployed the FDS for the first time, detects abnormal transactions by learning about 4 billion transaction information from nearly 200 million financial transaction users through AI. By utilizing machine learning, the false positive rate of abnormal transactions was lowered and the detection rate was dramatically improved.

However, there have been cases of damage due to different operating methods and insufficient system construction for each bank or credit card company that introduced FDS. Recently, the financial market is entering a new phase with the boom of cryptocurrency. In April of this year, the introduction of FDS in the cryptocurrency exchange ‘Cobit’ has been reported to prevent phishing damages amounting to USD 44,000, and once again the importance of AI-based FDS with advanced detection and response technologies is on the rise.

It is very clear that AI technology can be used to improve the level of security, reducing the damage to the users in the financial sector, especially in electronic financial transactions. However, since the electronic financial transaction fraud that once occurred can be attempted in various places with similar techniques, the detected information, data, and detection methods are actively shared with other financial institutions. Therefore, the FDS is used more effectively against advanced hacking methods across various fields.

As mentioned earlier, FDS is a method of establishing an institutional security system rather than reinforcing security from the perspective of service users, so if it is accompanied by strengthening the individual security awareness of the parties participating in the transaction, not only reinforcing the technical security system but also can directly impact in the reduction of potential phishing damages.